How rent payments work in Ailo

Liz Pollock

04 December 2021

Unlike traditional property management businesses, agencies using the Ailo platform can automatically disburse rental income to their landlords as soon as rent is paid. And in today’s economic climate, faster access to cash matters – a lot.

For property managers, that means less calls and emails from landlords checking on rental income, and the opportunity to build trust and connection by offering an elevated service.

How Ailo’s rent payment flow works — for property managers and investors

Prefer to skim an article over watching a video?

No problem, we can dive into the nitty gritty here for you…

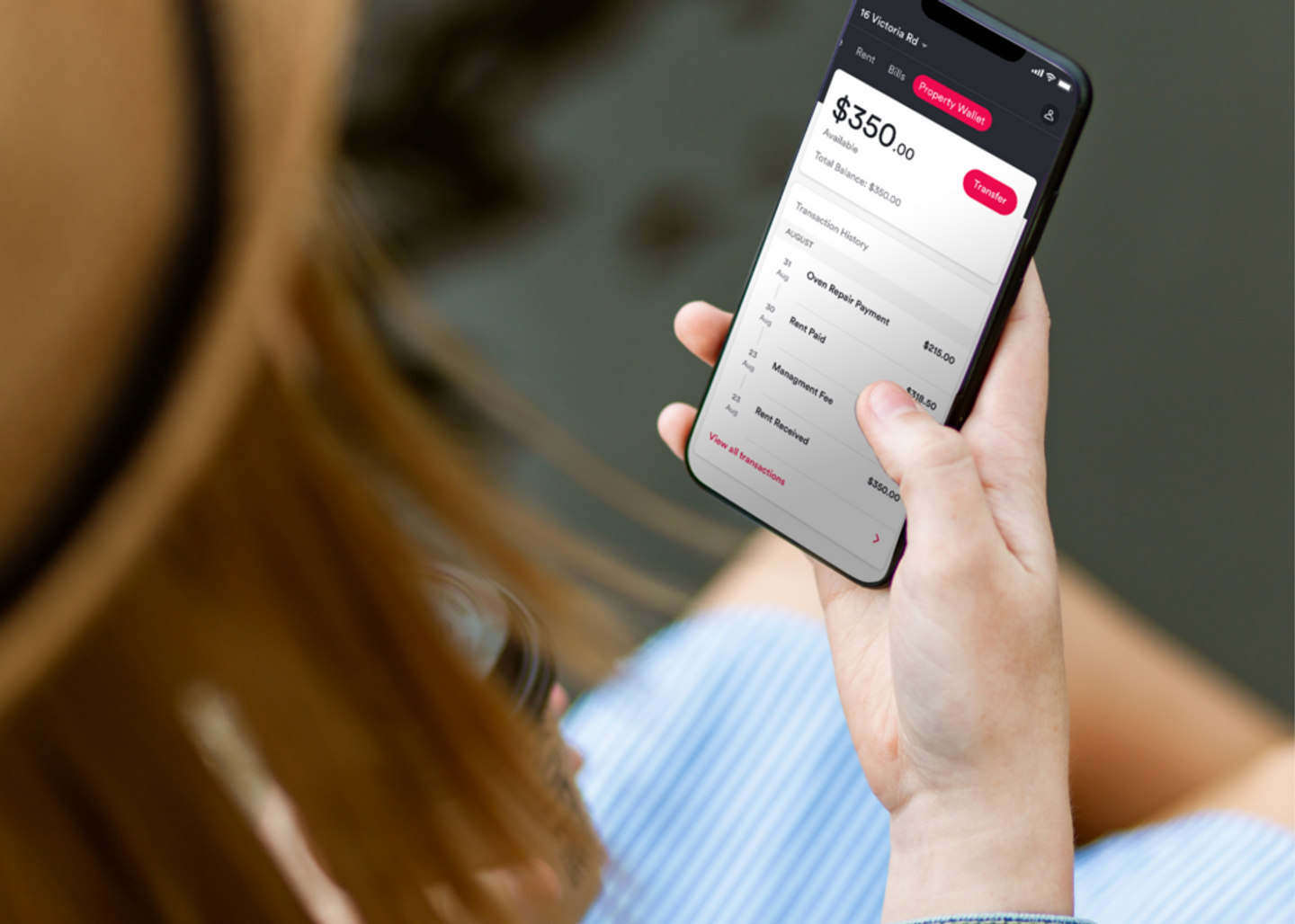

As soon as the tenant pays rent, we send the money directly to the property investor’s virtual Ailo Wallet, splitting off any agency fees that are owed to their property manager.

If the tenant pays rent with a credit or debit card, the money will arrive securely in the property investor’s Ailo Wallet within two hours. If they pay with direct debit, it may take up to two banking days.

Once the money arrives, property investors can either manually transfer the funds to their bank account or set up automatic transfers. The Ailo platform uses the latest payments technology (NPP), so investors can instantly transfer these to an eligible bank account within minutes, instead of waiting the usual 1-2 business days.

Clair Dobie, a property investor with Ray White Euroa in Euroa, pays off her mortgage faster because of Ailo.

“I can see when the money hits my bank account, enabling me to pay my mortgage every week instead of monthly. And the best part about that is that it brings my overall interest down, which will keep any investor happy.”