The four investor types

Adam Hooley

15 January 2020

When we start giving our customers a voice inside our business, we inevitably change the way we think about how we service them. Suddenly, we are finding that our internal processes are not customer-centric at all.

Ailo went about surveying 1,000 Investors that have their investment properties managed by a property management business. From the survey results, we were able to define four different investor types. Each of them had very different needs when it came to service levels, communication, and value.

Let me walk you through each of them.

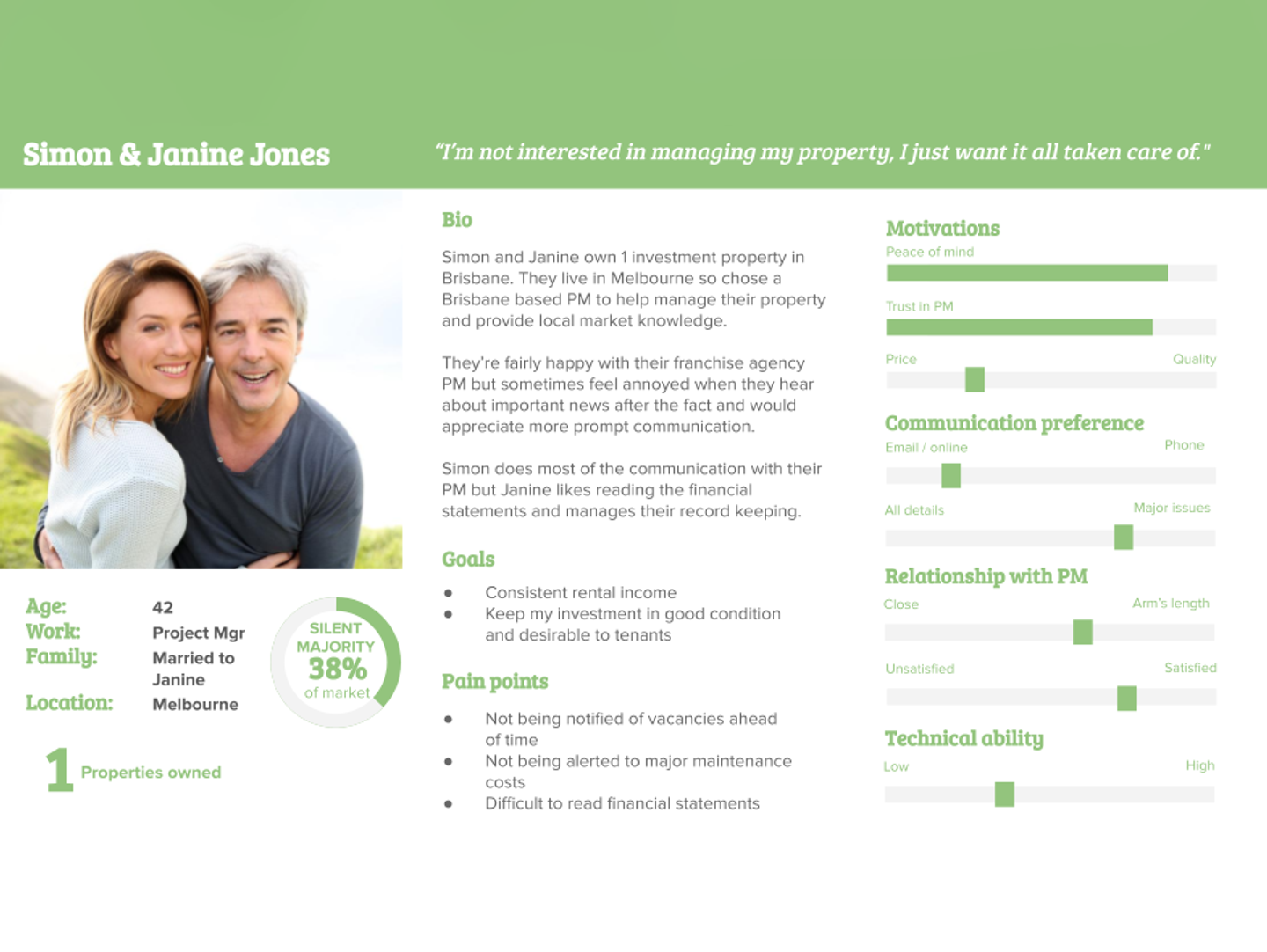

The 'Silent Majority' Investor

These investors are 38% of the market, making them the majority of your clients. They are often price-sensitive with a preference to be updated on significant events. They like to participate in these events through recommendations presented by their property manager. They generally trust their property manager and see value in the service they receive.

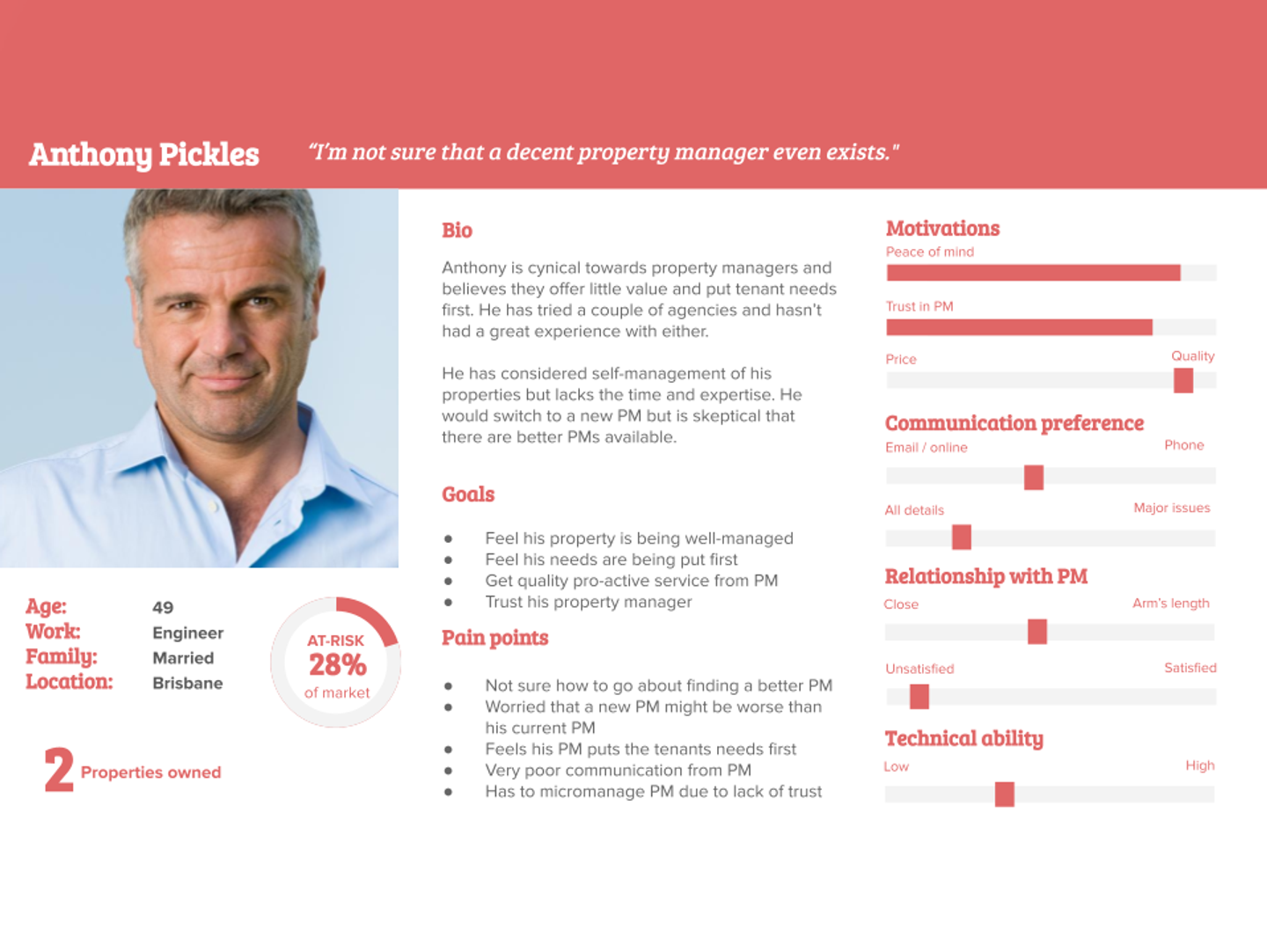

The 'At-Risk' Investor

These investors are quite cynical towards property managers and struggle to see the value of having their investment managed by a professional. They generally use a property manager because they acknowledge they don't have the time or expertise to do it themselves. They are driven by quality service. These investors are quite cynical towards property managers and struggle to see the value.

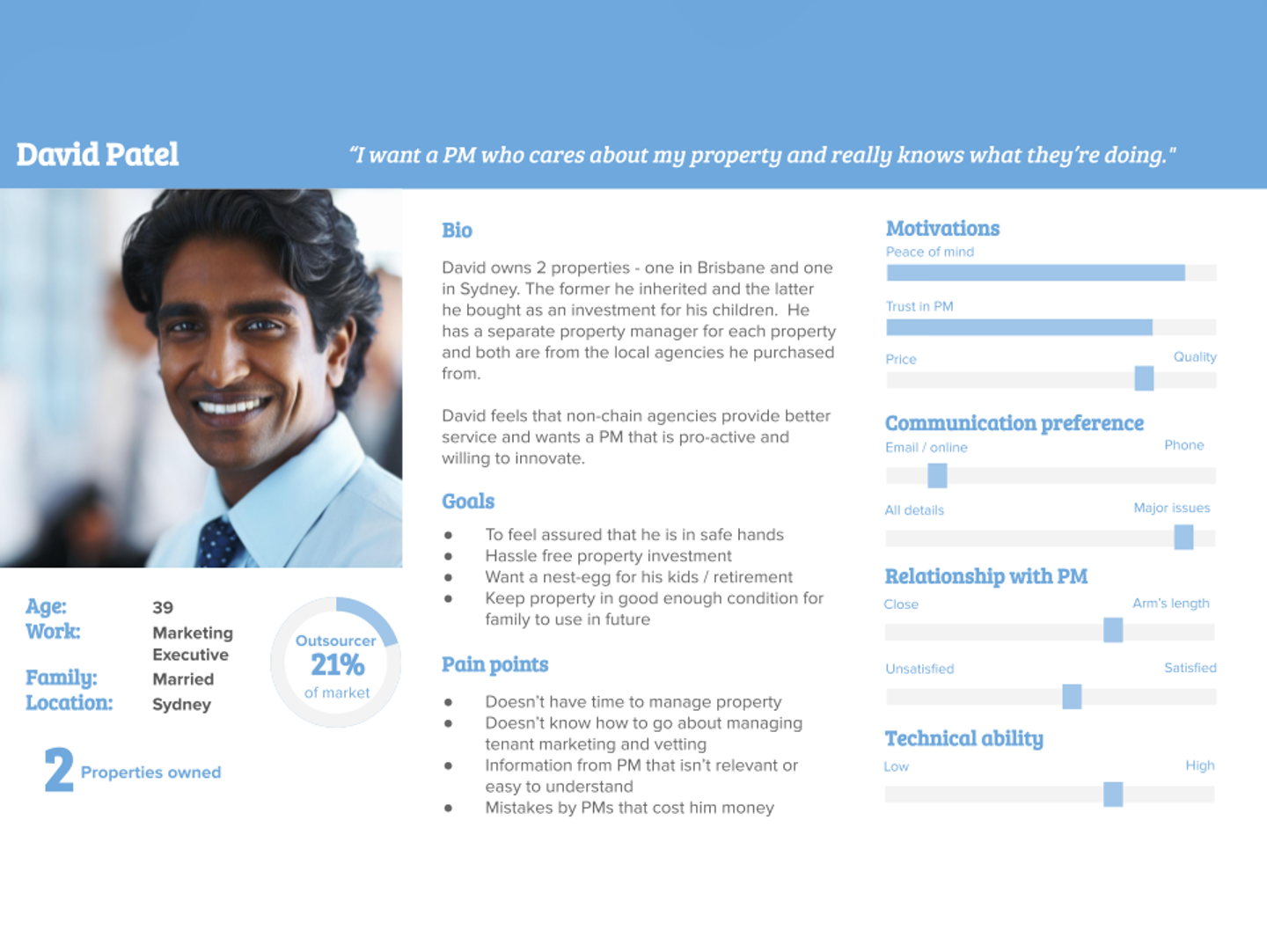

The 'Outsourcer' Investor

These investors are generally satisfied however, they require a knowledgeable, proactive property manager that will provide a hassle-free service. They like to know their property manager has everything in hand. These investors will choose service over price and are happy for the property manager to make most decisions. They like to know their property manager has everything in hand.

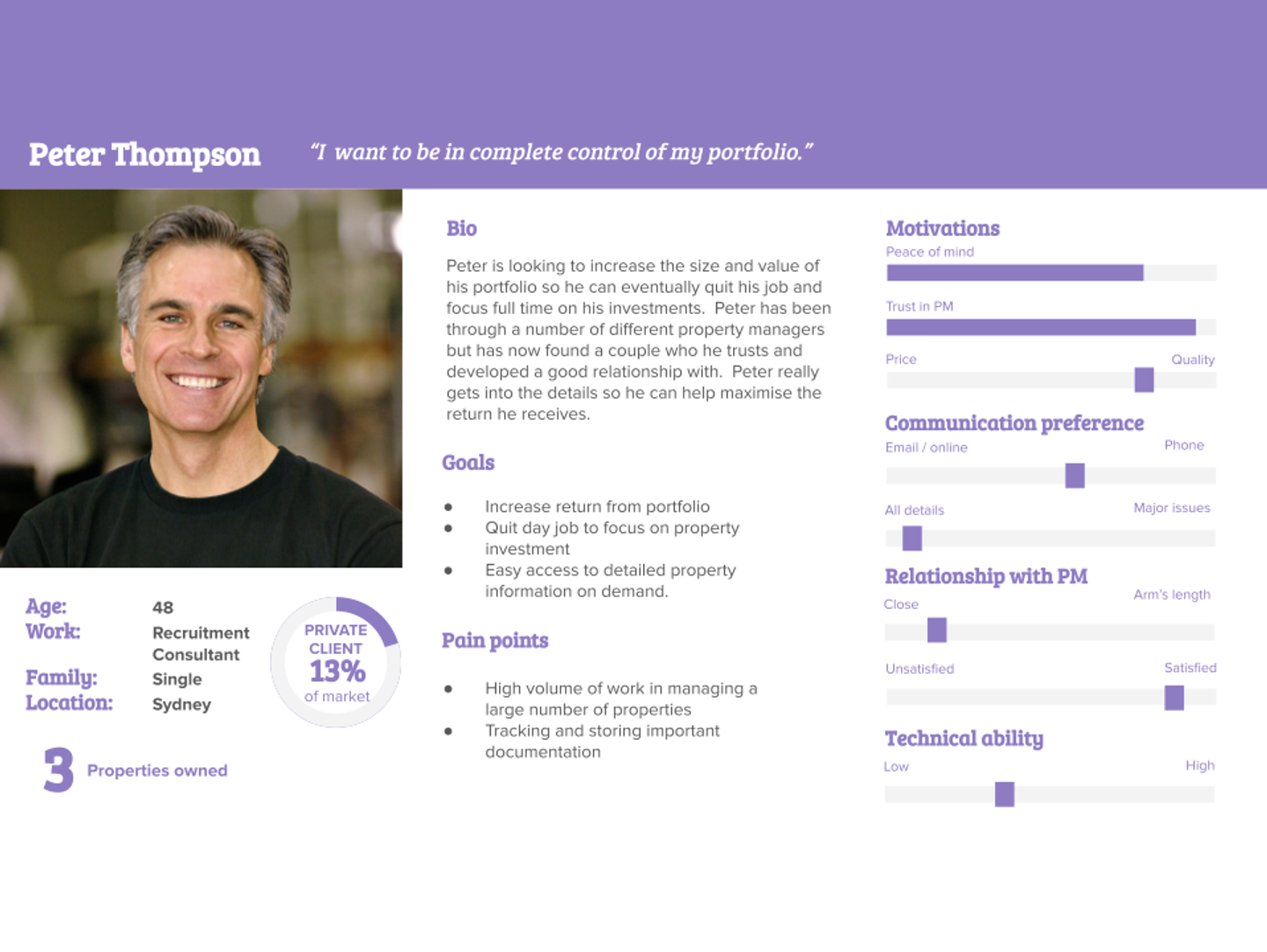

The 'Private Client' Landlord

These investors may have a larger portfolio and like to be actively involved in the management of their investment. They value service over price, but they are also the most likely to defect to another property manager if they are not happy. They see value in property management fees however demands the highest level of service. When reviewing feedback from your client surveys, rethink how you interpret this feedback. Different investors require a very different type of service, and bulking them into a 'one size fits all' mentality may not be creating promoters out of your clients.